RETAINED LIFE ESTATE

How it Works

How it Works

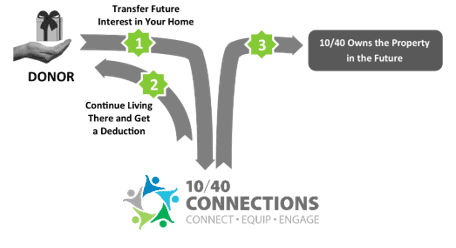

- You transfer your residence, farm, or vacation home to 10/40 Connections subject to a life estate.

- You continue to live in the property for life or a specified term of years, and continue to be responsible for all taxes and upkeep.

- The property passes to 10/40 Connections when your life estate ends.

Benefits

- You can give us a significant asset, but retain the security of using it for the rest of your life.

- You receive an immediate income tax deduction for a portion of the appraised value of your property.

- You can terminate your life estate at any time and may receive an additional income tax deduction.

The Details

You can deed your home, farm or vacation house, save taxes with a current deduction, and still use the property for the rest of your life.

Is this gift right for you? A retained life estate is for you if…

- You want to use your residence to make a gift to 10/40 Connections, but don’t want to move out.

- You are willing to deed your home, cabin, or farm to 10/40 Connections if you can continue to live there rent-free.

- You can continue to maintain your home.

- Your home is not subject to a mortgage or other obligations.

- You do not need the funds that would be generated by selling the property.

- You wish to reduce your estate taxes.

An attractive option for donating real estate is the retained life estate. This arrangement allows you to give your home to 10/40 Connections while retaining the right to live there for the rest of your life.

You will continue to be responsible for its taxes, structural maintenance, insurance, and upkeep. 10/40 Connections has no rights to the property nor, by law, any obligations. We mutually agree up front about what we will do if you no longer wish to live in the house or become physically unable to continue living there.

You will receive a charitable deduction based on the fair market value of your home minus the present value of the life tenancy you have retained. Additionally, any capital improvements, such as a new roof, may give rise to additional deductions.

With a retained life estate, you are able to make a significant gift to 10/40 Connections without disturbing your income or your living arrangements.

Please contact us so that we can assist you through every step of the process.

© 2024 10/40 Connections, Inc. All rights reserved.

10/40 Connections

P.O. Box 1141

Hixson, TN 37343

423.531.1040

10/40 Connections is a 501(c)3 tax-exempt organization.

Solicitation Disclosure | Privacy Statement | Statement of Faith | Mission Statement | 10/40 Blog | Employment | Contact Us

Where Most Needed

† If you desire to donate by check, it can be mailed to:

10/40 Connections

2120 Northgate Park Lane, #400

Chattanooga, TN 37415

10/40 Connections is a 501(c)3 tax-exempt organization.