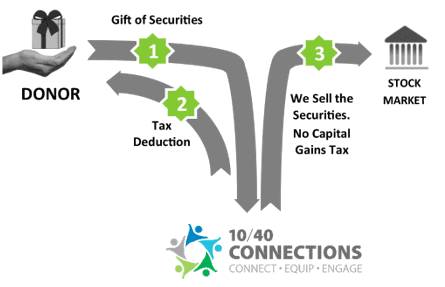

GIFTS OF APPRECIATED SECURITIES

Donating stocks, bonds, or mutual fund shares to 10/40 Connections is a great way to support the mission of 10/40. And with the right strategy, you may reduce your tax burden.

To Qualify

To Qualify

For special tax advantages when donating stock, you must have held your shares for more than one year. You will be eligible to receive an income tax charitable deduction for the full fair-market-value of your appreciated stock at the time of your donation. You will also pay no capital gains tax on the stock donation. Contact your broker or tax advisor for the specifics on how to transfer ownership to 10/40. We will then sell your securities and use the proceeds to fund the 10/40 project of your choosing, or you may designate the donation to be used Where Most Needed.

Important Tip: Don’t sell the stock first. Even though you may give us the proceeds as a gift, the IRS will impose capital gains tax on your sale, wiping out the benefits of this arrangement.

How?

Download instructions for gifting shares of stocks or mutual funds currently held in a brokerage account here.

Please contact us so that we can assist you through every step of the process.

© 2024 10/40 Connections, Inc. All rights reserved.

10/40 Connections

P.O. Box 1141

Hixson, TN 37343

423.531.1040

10/40 Connections is a 501(c)3 tax-exempt organization.

Solicitation Disclosure | Privacy Statement | Statement of Faith | Mission Statement | 10/40 Blog | Employment | Contact Us

Where Most Needed

† If you desire to donate by check, it can be mailed to:

10/40 Connections

2120 Northgate Park Lane, #400

Chattanooga, TN 37415

10/40 Connections is a 501(c)3 tax-exempt organization.