IRA

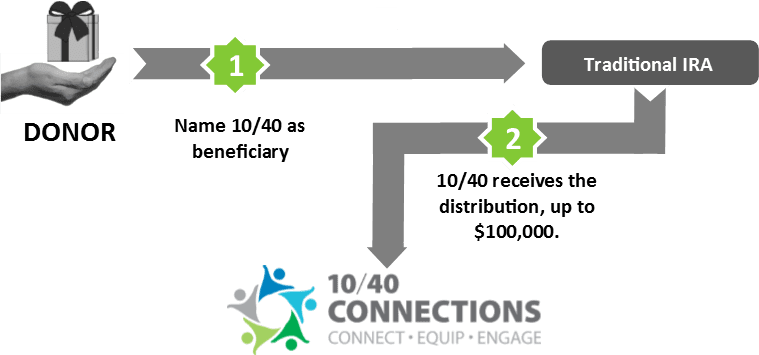

CONSIDER USING YOUR TRADITIONAL IRA TO MAKE A GIFT TO 10/40 CONNECTIONS USING THE IRA CHARITABLE ROLLOVER

In 2015 Congress passed the Protecting Americans from Tax Hikes Act (H.R. 2029). This act permanently extends the provision that allows individuals age 70½+ to make tax-free gifts directly from a traditional IRA account to a charity without incurring federal income tax on the withdrawal.

To complete an IRA charitable rollover, contact your IRA provider for instructions. Remember, you must be 70 1/2 or older at the time of the gift, AND the gift must be from a traditional IRA account.

You may donate up to $100,000 directly from your IRA account. For federal purposes, the distribution is not included in your taxable income and is not a tax deduction if the IRA was funded with pre-tax contributions to a traditional IRA. The gift can count towards your minimum required distribution for the year from your IRA. State laws vary, so be sure to consult with your own tax advisor.

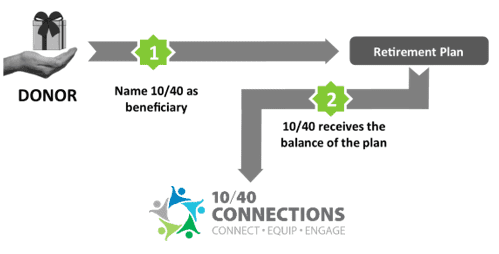

CONSIDER A BEQUEST OR BENEFICIARY DESIGNATION FROM YOUR IRA

You may also give from your IRA and other qualified retirement accounts when you pass away by designating 10/40 Connections as a beneficiary of part or all of the account. Such gifts do not generate a lifetime income tax deduction but are well-suited for charity since they avoid income and death taxes.

You may also give from your IRA and other qualified retirement accounts when you pass away by designating 10/40 Connections as a beneficiary of part or all of the account. Such gifts do not generate a lifetime income tax deduction but are well-suited for charity since they avoid income and death taxes.

For more information about making a gift from your retirement plan, click here. Or please contact us and we can walk you through the process.

© 2024 10/40 Connections, Inc. All rights reserved.

10/40 Connections

P.O. Box 1141

Hixson, TN 37343

423.531.1040

10/40 Connections is a 501(c)3 tax-exempt organization.

Solicitation Disclosure | Privacy Statement | Statement of Faith | Mission Statement | 10/40 Blog | Employment | Contact Us

Where Most Needed

† If you desire to donate by check, it can be mailed to:

10/40 Connections

2120 Northgate Park Lane, #400

Chattanooga, TN 37415

10/40 Connections is a 501(c)3 tax-exempt organization.